If you’re running a small business, every penny you spend will count. This means that you’ll need to think carefully about any accountancy software you choose to invest in. Two of the options designed with SMEs and entrepreneurs in mind are QuickBooks and FreeAgent – but which of these is best for your unique needs?

What is the target audience of QuickBooks and FreeAgent?

Both QuickBooks and FreeAgent target themselves at the smaller end of the SME and entrepreneur market. Both software packages will claim to cater for businesses of all sizes, but if we’re honest, the offering is wholly dedicated to smaller companies.

What kind of business would benefit most from QuickBooks vs FreeAgent?

If you’re going to make the most of either of these SaaS packages, use them to act in the place of a flesh-and-blood accountant and payroll manager. With an appropriate FreeAgent or QuickBook account, you won’t need such an employee – and you certainly won’t need to manage balancing the books yourself as a business owner when there are more pressing concerns at play.

It should be noted that these programs are very much designed for the small business market, though – especially FreeAgent. A business with a treble-figure employee headcount and more complex accounting needs may want to consider a different accounting software package.

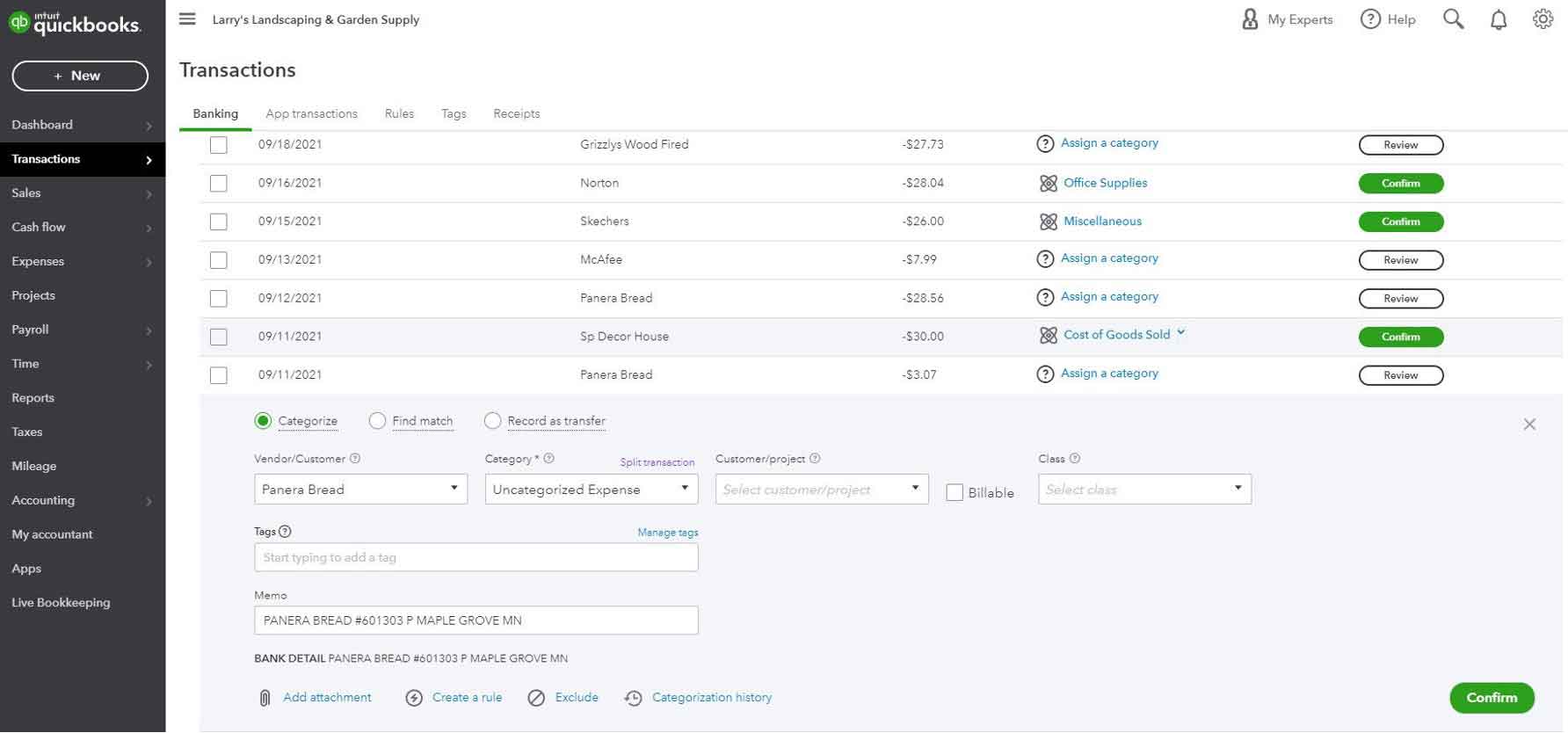

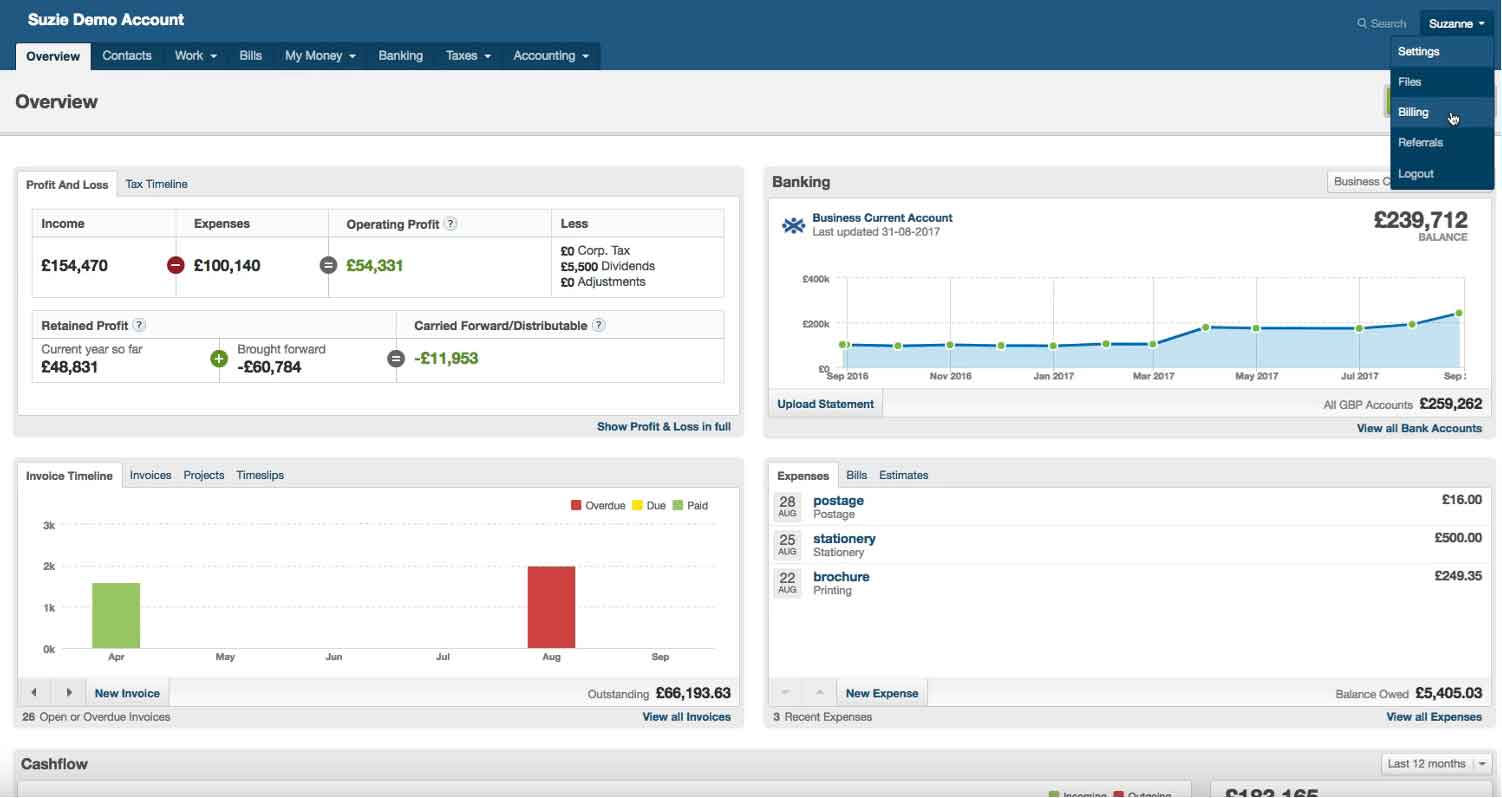

Features available on FreeAgent vs QuickBooks

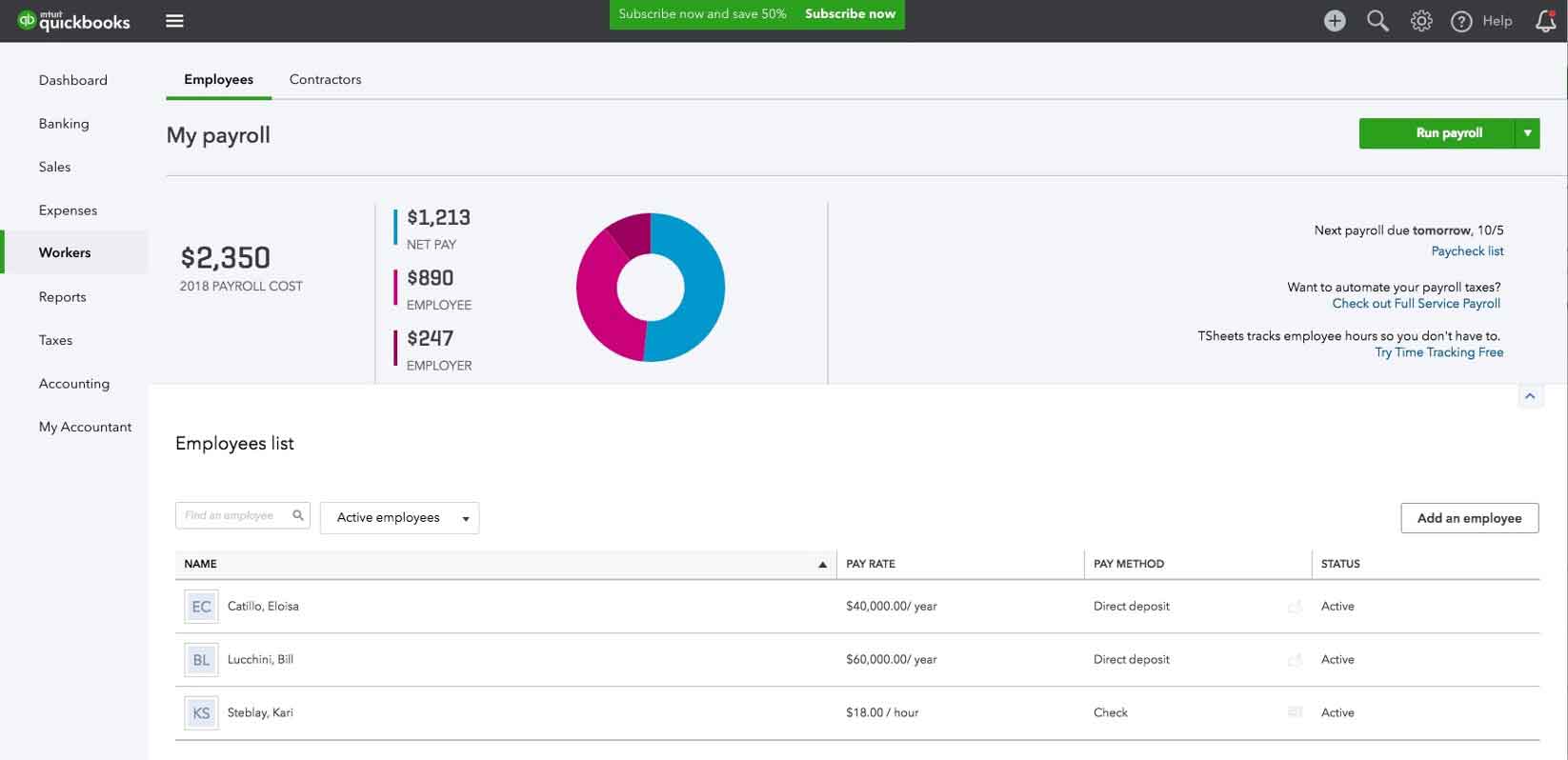

Both FreeAgent and QuickBooks are designed to be full-service accountancy software packages that track your spending and income. Both can also offer payroll services, though you’ll need to pay extra for this on QuickBooks.

However, the flip side is that QuickBooks offers more complex reporting options than FreeAgent. The latter is more of a one-stop-shop for all basic and intermediate accountancy needs, while QuickBooks can help with more challenging and multifaceted requirements.

Is QuickBooks or FreeAgent more user friendly?

Both software packages pride themselves on their user-friendliness, as QuickBooks and FreeAgent have the same aim – to negate the need for an experienced accountant to balance your books.

This means that it’s essentially a tie when deciding which platform has the more intuitive user interface. If push comes to shove, however, FreeAgent could be considered earlier to use – purely because QuickBooks has more features, leading to greater complexity in places.

Do QuickBooks or FreeAgent offer better customer service?

If there is a fault to be levied at QuickBooks, it’s the level of customer service provided. The telephone support team take quite some time to be reached if you have a technical problem with QuickBooks, and the training of the staff at the other end of the line is not always comprehensive.

At FreeAgent, there are a handful more options in terms of help and support. A 24-hour live chat facility is welcome, albeit manned by chatbots, and you’ll typically get the help you need a little faster by email or phone. This can make all the difference when using SaaS to handle accountancy needs, as the whole purpose of outsourcing these duties is to save time.

What do existing customers say about QuickBooks and FreeAgent?

Checking scores left by users on the consumer review portal TrustPilot is a great way to see what existing users think of a software package. Both QuickBooks and FreeAgent have an Excellent ranking, with the former boasting a total score of 4.4 from 8,052 reviews and the latter scoring 4.7 from 1,743. When reviewing the high tally for FreeAgent, keep this limited number of reviews in mind, but both packages clearly meet consumer needs.

What are the cost implications of FreeAgent vs QuickBooks?

We opened this guide by discussing how important the financial implications of choosing accountancy software can be to an entrepreneur or SME. This means that you’ll need to choose what license you decide to commit to carefully.

Let’s start by addressing QuickBooks. The flat rate charges of this software range from £12 to £32 per month, depending on how advanced a package you’ll need. As you can imagine, the more you are willing to spend, the more features you’ll receive in return for your investment.

If you’re looking for payroll services, you’ll need to spend even more – either £4 or £8 per head. That can obviously start to become pretty costly. The good news is that a 75% discount is available for the first six months of use, though. This is more than long enough to learn if QuickBooks is right for your business.

FreeAgent also offers a discount for six months, but this is only 50%. The package does provide a 30-day free trial, though. Beyond this, the package is a flat rate of £29 per month – but here’s the kicker. If your business account is held with NatWest, Royal Bank of Scotland, or Ulster Bank NI, FreeAgent lives up to its name – it’s completely free. This is because the software is owned and operated by NatWest Group.

Summary of QuickBooks and FreeAgent

We have discussed some of the fundamental qualities of QuickBooks and FreeAgent, but it’s easy to be overwhelmed by the sheer amount of data we have discussed. To help you decide and compare everything we have discussed, here’s an ‘at a glance’ summary of the two software programs.

| Characteristic | QuickBooks | FreeAgent |

|---|---|---|

| Suitability for Entrepreneurs | * * * * | * * * * |

| Suitability for SMEs | * * * * | * * * |

| Suitability for Large Businesses | * * | * |

| Range of features | * * * | * * * |

| User-friendliness | * * * * | * * * * |

| Customer service | * * * | * * * * |

| Cost | * * * | * * * |

Final verdict – is QuickBooks or FreeAgent best for your business?

It’s tough to separate the qualities of FreeAgent and QuickBooks, but ultimately, the size of your business should dictate which software you choose. If you’re an entrepreneur with a tight budget and a small team, you’re probably better served opting for FreeAgent. As your business grows, however – and the need for more elaborate and complicated accountancy reporting becomes more pressing – QuickBooks merits further investigation.