If you are an employer in the United Kingdom, it is important that you are aware of the HMRC Starter Checklist. In this article, we will explain everything that you need to know about the Starter Checklist, including what it is, what it contains, and how to fill out the form correctly.

We will also provide answers to some common questions that employers have about the Starter Checklist. So if you’re ready, let’s get started!

What is the HMRC Starter Checklist?

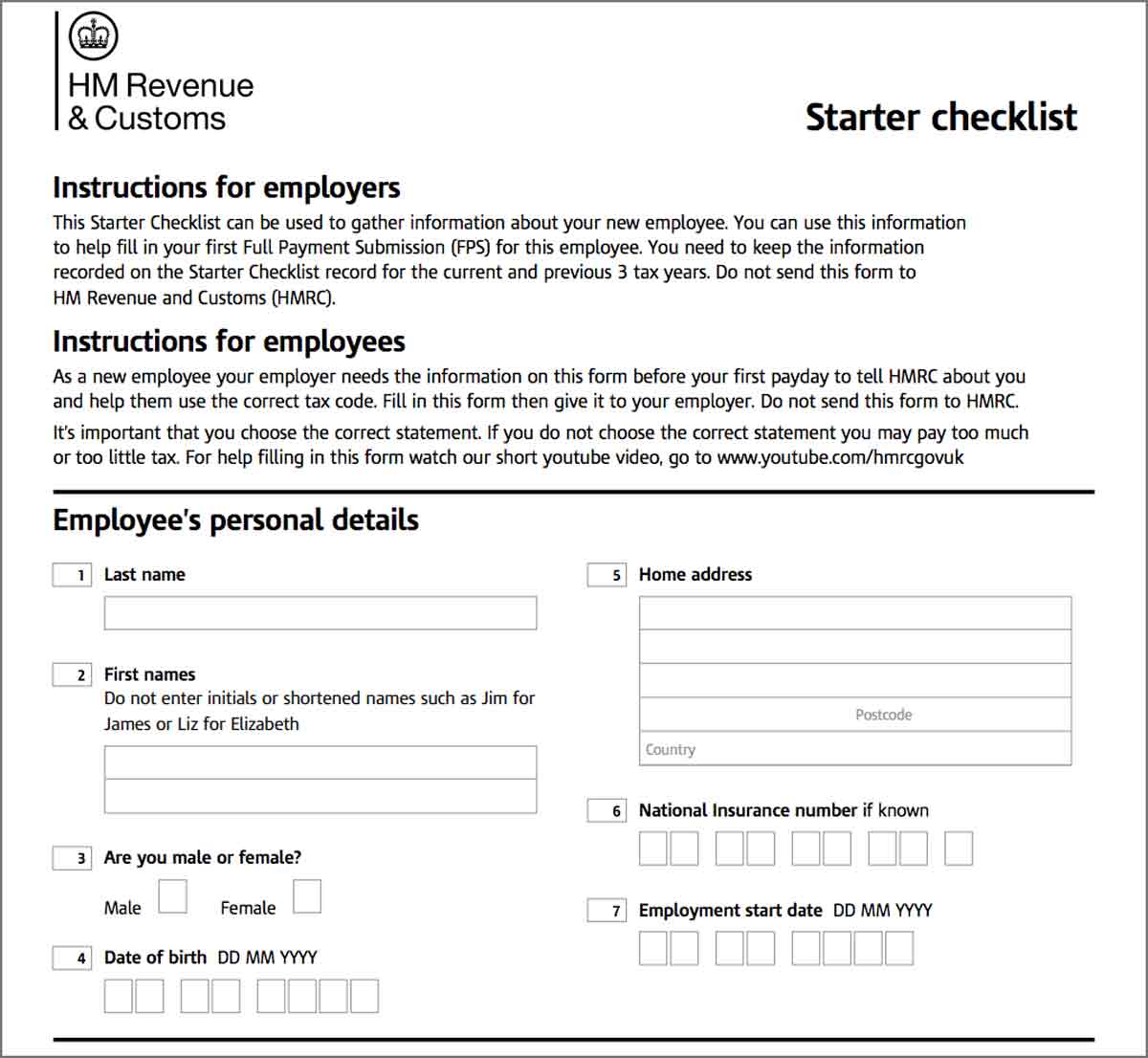

The Starter Checklist is a document that contains all of the information that HMRC requires employers to know about a new employee before they can be added to payroll (if no P45 is presented). This includes their personal details, such as their name, address, and date of birth, as well as information about their eligibility to work in the UK.

Do you need a Starter Checklist if you have a P45?

If you have a P45 for your new employee, then you will not need to complete the checklist. However, if your employee does not have a P45 (for example, if they are starting their first job), then you will need to collect the information from the Starter Checklist in order to add them to your payroll.

What does the Starter Checklist contain?

The Starter Checklist contains a number of different sections, each of which must be completed in order for the form to be considered valid. These sections include:

- Personal Details: Here you will need to provide the employee’s name, address, and date of birth.

- National Insurance Number: The employee’s National Insurance Number must be provided in order for them to be eligible for certain benefits, such as Statutory Sick Pay.

- Tax Code: The employee’s tax code will determine how much tax they will pay.

- Start date: The employee’s start date must be provided.

- Employee Statement: The employee must tick a box here – more about this below.

- Student Loan: If the employee has a student loan, you will need to provide information about this in order to deduct the correct amount from their salary.

Once all of the information has been collected, the Starter Checklist must be signed by the employee in order to be considered valid.

Understanding the three employee statements

The Starter Checklist is used to help employers determine the correct tax code for their new employees. The three statements that are used to calculate the tax code are:

| Employee statement | Explanation |

|---|---|

| Statement A | This statement is used for employees who have no other source of income besides their wages from their current job. |

| Statement B | This statement is used for employees who have another source of income (such as a pension), in addition to their wages from their current job. |

| Statement C | This statement is used for employees who have more than one job, or who have changed jobs during the tax year. |

What is a Starter Checklist used for?

A Starter Checklist is used to inform HMRC of a new employee that you wish to add to your payroll. This allows HMRC to calculate the correct amount of tax to deduct from the employee’s wages, as well as ensuring that they are eligible for certain benefits, such as Statutory Sick Pay.

How to fill out a Starter Checklist form for HMRC?

The process for filling out a Starter Checklist form is relatively straight-forward. Simply enter the required information into each section of the form, being sure to double-check for any mistakes before submitting it.

One common mistake that employers make is forgetting to include the employee’s start date. This information is essential for HMRC in order to calculate the correct amount of tax to deduct from the employee’s wages.

Another thing to keep in mind is that you will need to provide the employee’s National Insurance Number in order for them to be eligible for certain benefits, such as Statutory Sick Pay. If the employee does not know their National Insurance Number, they should contact HMRC.

Common mistakes to avoid when filling out a Starter Checklist

As with any government form, it is important to avoid any mistakes when filling out a Starter Checklist. Some of the most common mistakes include:

- forgetting to include the employee’s start date

- forgetting to provide the employee’s National Insurance Number

- selecting the wrong Employee Statement; and

- the employee not signing in the correct place.

Any of these mistakes could result in the Starter Checklist causing payroll errors, which could cause incorrect deductions or incorrect payments.

FAQ

The three employee statements on the Starter Checklist are: Statement A, Statement B, and Statement C.

Statement A is used for employees who have no other source of income besides their wages from their current job.

Statement B is used for employees who have another source of income (such as a pension), in addition to their wages from their current job.

Statement C is used for employees who have more than one job, or who have changed jobs during the tax year.

The Starter Checklist can be downloaded from HMRC’s website.

A completed Starter Checklist must be used internally by the employer or payroll department. The completed form should not be sent to HMRC.

Yes, the Starter Checklist is available to download as a Word document from HMRC’s website.

The Starter Checklist is available to download as a PDF from HMRC’s website.

A Starter Checklist must be submitted to the employer before the employee begins employment.